Add Client with their Bank detail

Our system allows you to add your client with their bank details, because of this you have full records of client's backgrounds.

CRM for Loan Management permits you to deal effortlessly and manage entire tasks from the loan creation to the loan execution and it is used to analyze the performance for expanding the ROI and limit hazard. It is an obvious fact that the world we live in is developing and getting computerized. Progressively, an ever-increasing number of tasks that are conducted online.

A centralized platform to capture, track, and manage every loan enquiry, document, and follow-up in one place.

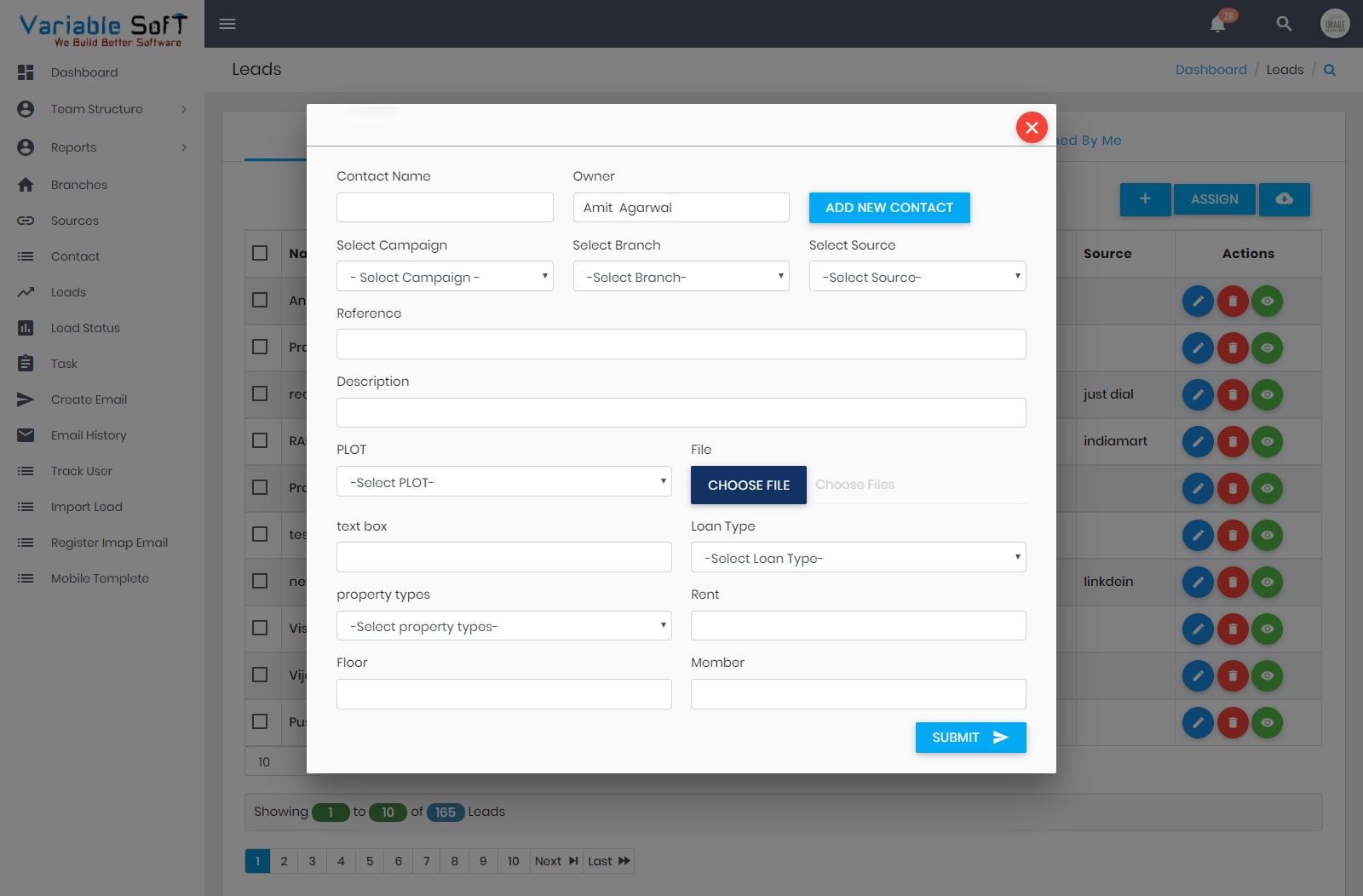

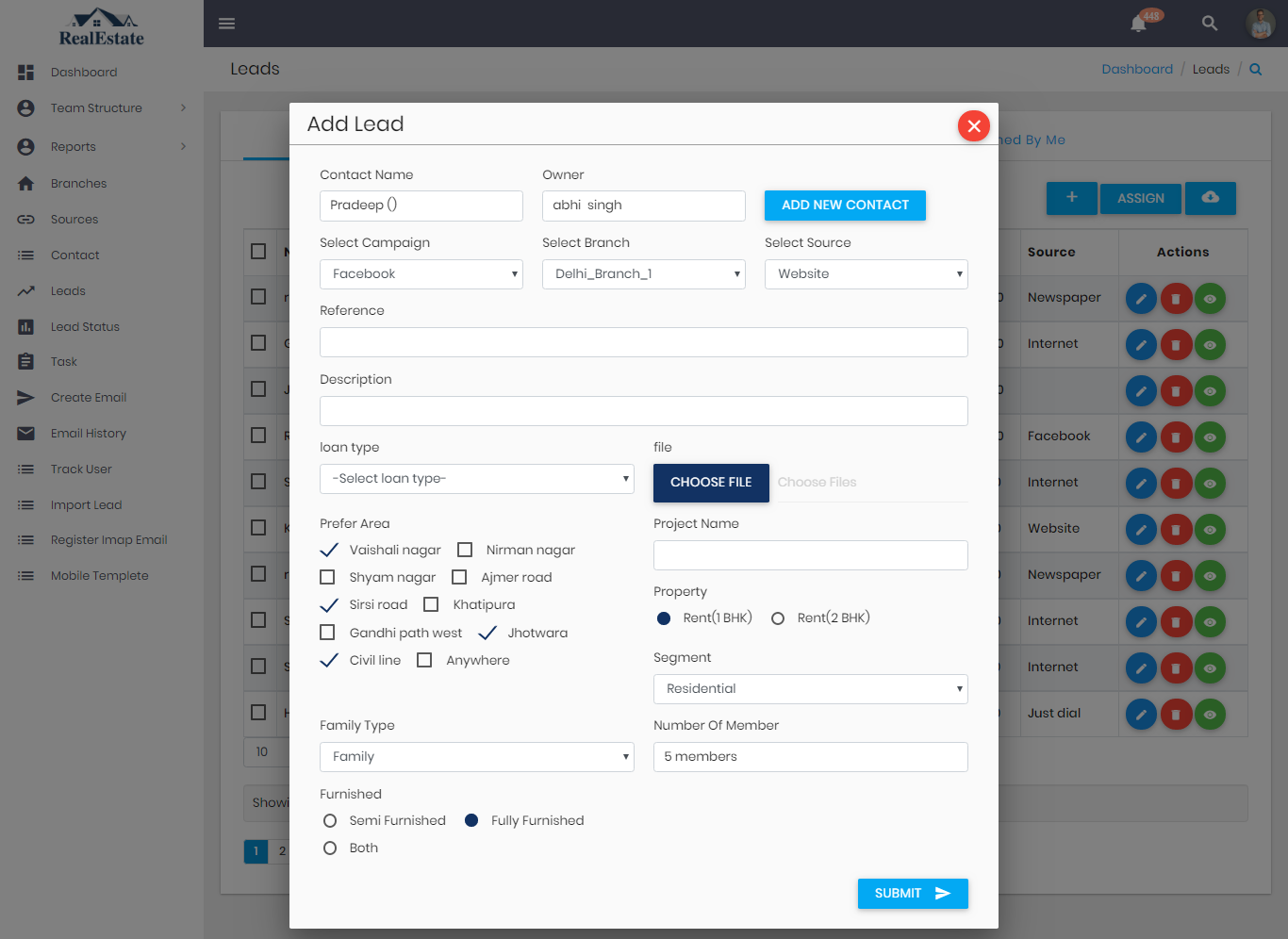

Add Loan Lead in Seconds

Capture contact, branch, source & priority instantly.

Loan Management software is software that makes the entire process of Loan make easier and have all the records of data for further use for investigation or for keeping safe. All the data are easily fetched and stored by using the Loan Management software. The entire process of loan management becomes easy and it makes the faster browser facility.

Maintain a single source of truth for all loan applications, KYC documents, and communication history.

Automate follow-ups, reminders, and status updates to speed up approvals and reduce manual work.

Instantly filter and search records for compliance checks, audits, or performance reviews.

Works smoothly in modern browsers so your team can access the system from office or field.

Variable Soft is a very much reputed software development company in India and we are famous for our on-time delivery and quality of work.We work on the principle of confidently and privacy by this we make sure that your data and information remain safe and secure.Our highly qualified and professional developers always take of quality of CRM Solution.

Trusted by multiple businesses across India for stable, scalable and industry-ready CRM solutions.

We work on principles of confidentiality and privacy so your loan data remains safe, encrypted and audit-ready.

Highly qualified developers and implementation experts who focus on performance, usability and quality.

There is the great benefit of specialized CRM for loan management like its straightforward for the loan candidates and makes the borrowing easy. It used to capture the leads from the various digital channel and save the time of low-quality inquiry and automatic pre-screening check, enhance the profit margin of the company and many more. Variable Soft best CRM for loan management as it helps in engaging with the clients at the correct time and it's throughout their financial journey.

Auto pre-screening removes low-intent enquiries and keeps your team focused on high-potential borrowers.

Save hours of manual effort with automated tasks, reminders, and follow-up sequences.

Improve approval rates and cross-sell opportunities by engaging customers at the right time.

Engage customers with timely updates and personalised communication throughout their financial journey.

Auto pre-screen every enquiry

Reduce manual checks with smart rules and scoring.

Everything your team needs to manage borrowers, repayments and documents from a single, intuitive platform.

Our system allows you to add your client with their bank details, because of this you have full records of client's backgrounds.

On our CRM system, you will get the full details of the EMI from its starting date and its percentage and many more.

Variable Soft CRM for Loan management has an automated EMI reminder system that reminds you regarding the EMI.

Our CRM system has records of entire payment details and this is arranging in a good way so that agents can understand it in an easy way.

The loan status of any client can be seen here. The agent does not need to make an effort for searching the loan status. They just have a link on the status of the loan module and you will get your answer.

For keeping the document of a client at a place so we have also provided the feature that you can upload your client document by using our beneficial CRM system for loan management.

From enquiry to closure, every step is structured so your team always knows what to do next.

Capture enquiries from website forms, social campaigns, inbound calls and walk-ins into a single loan pipeline.

Run quick eligibility checks with income, profile and bureau inputs to qualify the right borrowers.

Collect documents, manage verifications and track file status with task lists and internal SLAs.

Manage disbursement, EMIs and renewals with automated reminders and real-time portfolio visibility.

VS CRM Loan Management adapts easily to your lending model and workflows.

Manage retail loans, top-ups and balance transfers with strong compliance and reporting.

Track property loans, builder tie-ups and legal documentation with full visibility.

Handle dealer leads, stock funding and retail auto loans in a single interface.

Support group lending, small-ticket loans and loan-against-property with flexible workflows.

Answers to common questions about VS CRM Loan Management.