Contact Management

This module used to manage entire contact which is available on our system.

Insurance Protection is an extremely specialized product that depends on close client interaction, utilizing CRM, insurance agents can have a superior image of the client's necessities before they even get in touch with them.

A CRM procedure includes interpreting, recording, and analyzing data about behaviors and preferences, all through the client excursion and beginning even before the primary buy is made. Surpass expectations by delivering personalized experiences for policyholders using our CRM software for insurance companies, designed to streamline communication, automate workflows, and improve customer satisfaction.

Policyholder 360°

Single View

Quotes, policies, claims & conversations in one profile.

Automation

+30%

More timely renewals & cross-sell campaigns.

NPS / CSAT

↑

Personalised journeys that boost satisfaction.

Why Insurance CRM?

Make every client interaction data-driven.

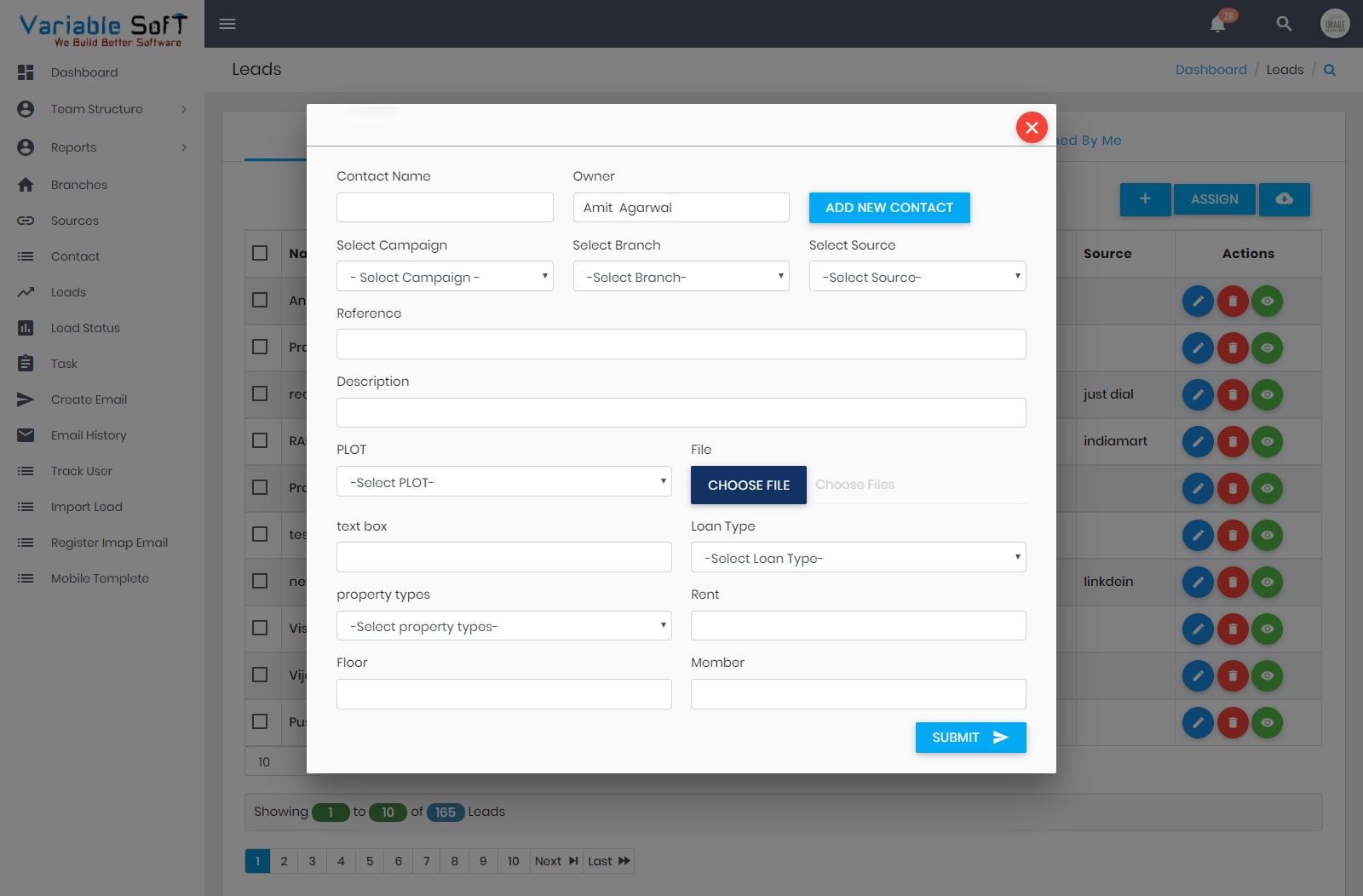

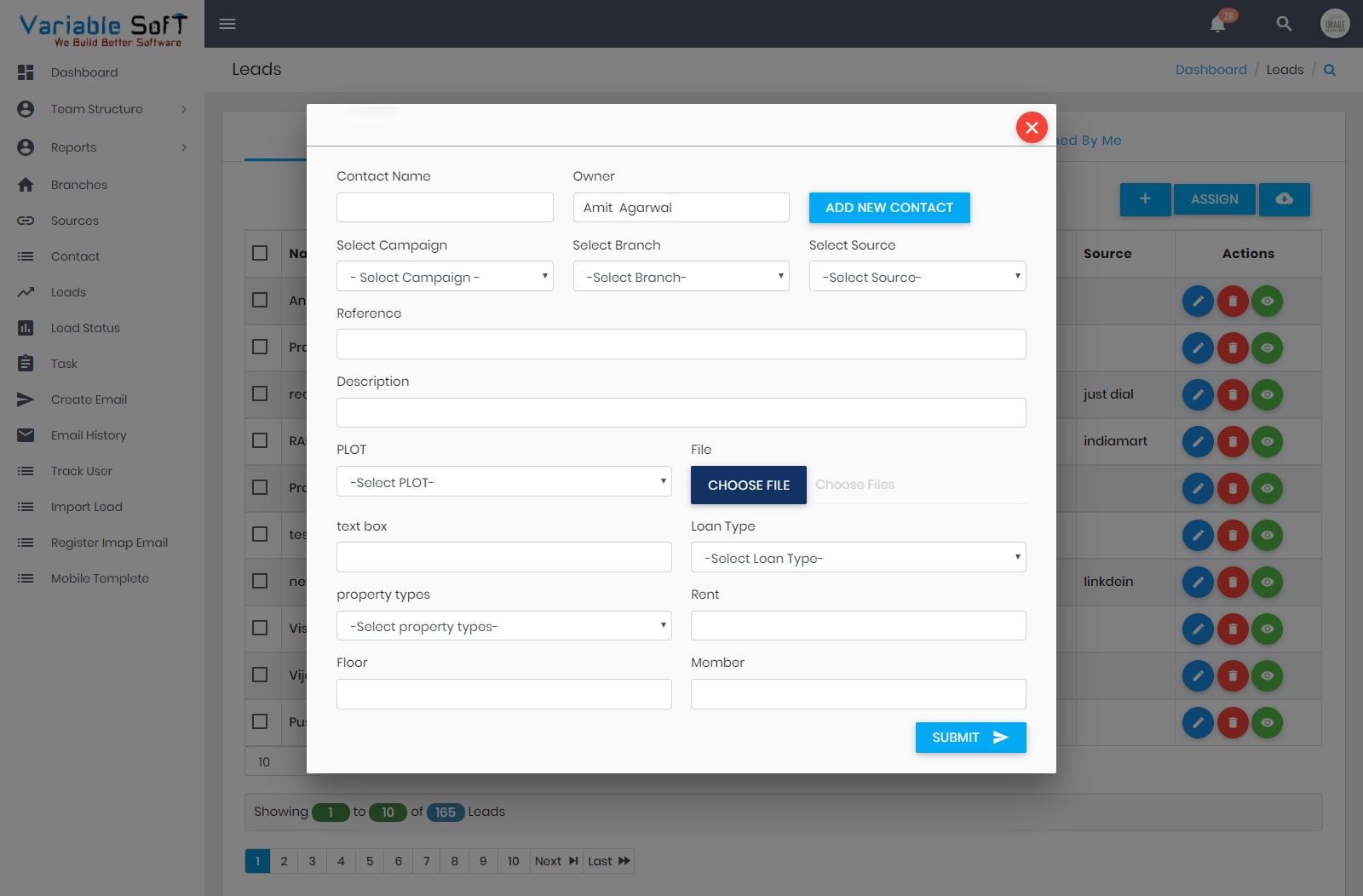

Product Overview

We know that ease of use of ordinary activities is significant for end-clients, along these lines we focus around the look and feel of business solution at both the implementation stage and design.

Our CRM software for insurance agents India is designed to efficiently handle the full range of insurance operations, including life, casualty, and property. It supports all aspects of an insurer’s business—from client servicing to sales and policy management.

Insurance CRM Advantage

Variable Soft CRM for Insurance Industry is amazing in permitting customizations, dissimilar to huge CRMs. Automations assist us in connecting with clients without deferrals, and we have expanded our conversion rates. The lead catch is seamless from all sources. The in-build connectors, Webhooks and APIs are easy to utilize and can be merged with your core systems.

One of the best reasons to go with Variable Soft CRM for Insurance is like we are famous for our CRM products for various industry and we are very much punctual for our work. So,it’s good to hire a company that has great experience as well as offers the best price as we are providing. We will work with you to devise the ideal integration procedure, approach, and plan that will work with your budget limit and current infrastructure.

CRM for Insurance Industry provide efficient customer service and supporting

personalized. CRM system offers insurance agencies the chance to help clients

all through their lifetime, expanding their excursion with the organization

rather than essentially giving services at the time.

Insurance companies need to deal with forms, agreements, reports and different

records. These documents are stored at a central database and can be accessed

by all inner and outside staff. Having the option to discover data quicker

implies that representatives can work all the more effectively.

Feature of Variable Soft CRM for Insurance Industry

This module used to manage entire contact which is available on our system.

This module allows user to monitor the mails which you sent to customers like you sent a mail to the customer for a discount or for a new offer, so by this tool you will able to identify whether the user has seen the email or not.

Our CRM for Insurance Industries is integrated with social media like Facebook, Skype, Instagram and Twitter. So that insurance companies can connect with their customer on social media.

Our system makes your work easier by managing the task and meeting. This will save lots of time and you can use this time for some other decision-making task.

The entire system can be managed by using the dashboard of our CRM system. The dashboard will also show all the entire perforce by graphical representation.

By one click you can dial any call and message your customer from our developed modern CRM for Insurance company.

By using our CRM for Insurance Industry, you can monitor entire team performance.

The entire system can be managed by using the dashboard of our CRM system. The dashboard will also show all the entire perforce by graphical representation.

Our CRM platform offers specialized solutions to address the unique challenges faced by insurance providers.

Streamline policy creation, renewal tracking, and endorsement management with automated workflows and reminders.

Accelerate claims handling with automated intake, status tracking, and seamless communication between all stakeholders.

Empower your agents with tools for lead management, commission tracking, and performance analytics.

Gain insights with customizable dashboards, performance metrics, and compliance reporting tools.

Engage policyholders through multiple channels with automated reminders, personalized messaging, and self-service portals.

Ensure data protection and regulatory compliance with robust security features and audit trails.

We provide end-to-end services to ensure your CRM implementation is successful and delivers maximum value.

We handle the complete implementation process, from system configuration to data migration, ensuring a smooth transition to our CRM platform.

Comprehensive training programs tailored for different user roles within your insurance organization.

We extend our CRM platform to meet your specific business requirements with custom development.

Continuous support to ensure your CRM system operates smoothly and evolves with your business needs.

Discover how our CRM platform transforms operations for insurance providers of all sizes.

A leading life insurance company reduced policy issuance time by 40% and improved agent productivity by 25% with our CRM.

A P&C insurer streamlined claims processing, reducing average handling time by 35% and improving customer satisfaction scores.

An agency network with 200+ agents improved cross-selling by 30% and reduced administrative overhead by 50% with our platform.

Automated workflows reduce manual tasks by up to 60%

Faster response times and personalized service

Agents can handle 25% more policies with the same resources

Real-time analytics provide insights for strategic planning

Trusted by leading insurance professionals across India.

“VSCRM helped us streamline policy management and boost agent productivity instantly.”

“Claims processing became faster and smoother — automation made a huge impact.”

“Our 75-agent team now manages leads and commissions effortlessly with VSCRM.”